Flexible Spending Accounts (FSAs) are a popular way for employees to set aside pre-tax money for eligible healthcare expenses. This includes copayments, prescription medications, medical supplies, and other qualified medical costs. For the 2025 tax year, the contribution limits for healthcare FSAs have increased:

Flexible Spending Accounts (FSAs) are a popular way for employees to set aside pre-tax money for eligible healthcare expenses. This includes copayments, prescription medications, medical supplies, and other qualified medical costs. For the 2025 tax year, the contribution limits for healthcare FSAs have increased:

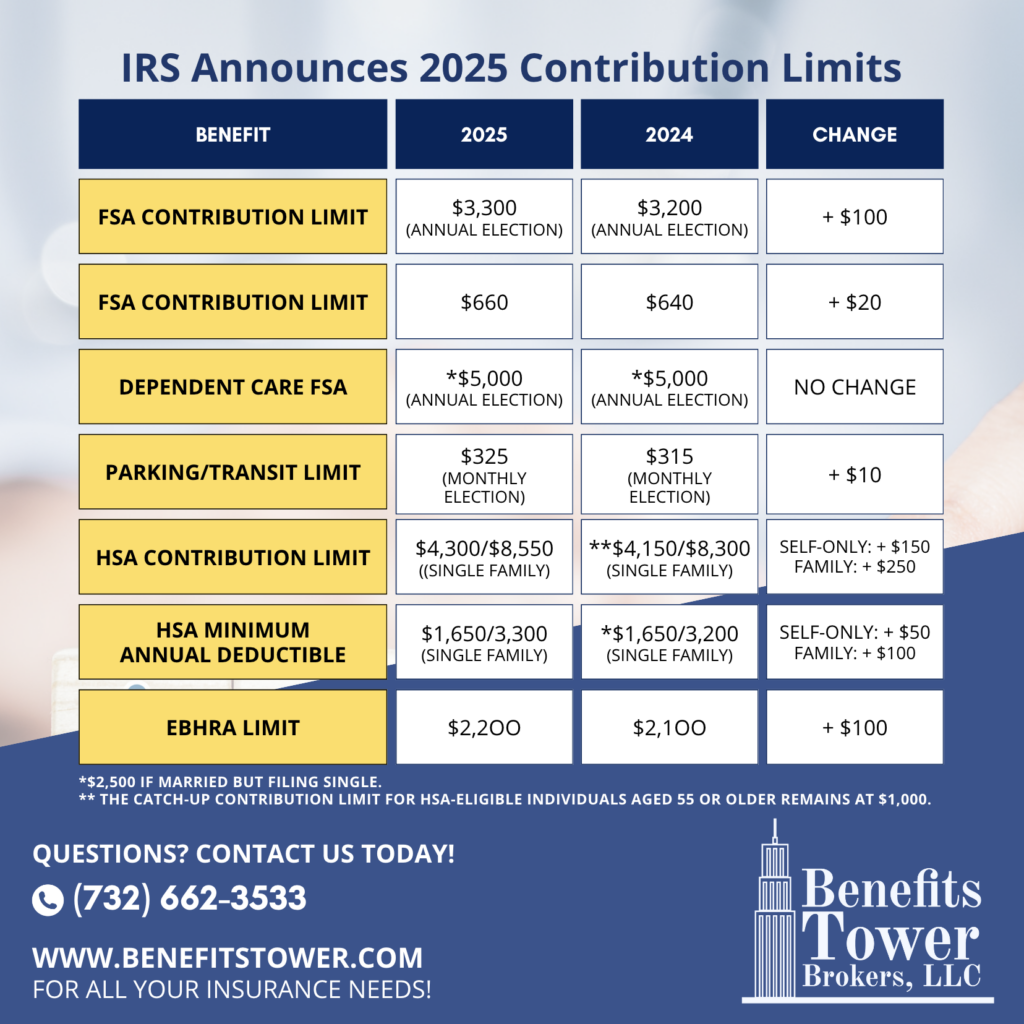

- Maximum Annual Contribution: $3,300 (up from $3,200 in 2024)

- Carryover Amount: $660 (up from $640 in 2024)

This means employees can allocate more funds pre-tax to cover their expected medical expenses throughout the year. Additionally, if their employer offers the option, participants may carry over up to $660 of unused FSA funds to the following year, providing flexibility for unexpected expenses.

Dependent Care FSA Limits

The contribution limit for Dependent Care FSAs remains unchanged for 2025:

- Maximum Contribution: $5,000 per family

Dependent Care FSAs allow employees to set aside pre-tax dollars to cover childcare or dependent care expenses, offering significant tax savings for working families.

2025 Commuter Benefits Contribution Limits

In addition to healthcare expenses, employees can save on commuting costs through pre-tax commuter benefits. These benefits cover expenses like public transportation and parking. For 2025, the IRS has increased the limits for both transit and parking benefits:

- Transit Account Monthly Limit: $325 (up from $315 in 2024)

- Parking Account Monthly Limit: $325 (up from $315 in 2024)

Using commuter benefits, employees can reduce their taxable income while offsetting the rising costs of commuting to work, whether through public transit or parking fees.

Maximizing Your Savings in 2025

The new contribution limits provide more opportunities to save on taxes while planning for medical, dependent care, and commuting expenses. Here are a few tips to make the most of these updated limits:

- Review Your Healthcare Needs: Estimate your medical expenses for the year, including planned procedures and medications, to maximize your FSA contributions.

- Assess Your Commute: If you rely on public transportation or drive to work, consider how much you can contribute to your transit or parking benefits to cover these costs pre-tax.

- Coordinate with Other Accounts: If you have a Health Savings Account (HSA) in addition to an FSA, strategize how to allocate funds across both accounts to optimize your savings.

What Employers Need to Know

Employers offering FSAs and commuter benefits should update their plan documents to reflect these new limits for 2025. It’s also important to communicate these changes to employees so they can make informed decisions during open enrollment and maximize their tax savings.

Conclusion

The 2025 IRS contribution limits for FSAs and commuter benefits reflect a modest increase, allowing employees to save more on essential healthcare and transportation expenses. By staying informed of these updates, both employers and employees can make the most of tax-advantaged accounts in the year ahead.

Information provided by https://oca125.com/irs-announces-2024-fsa-commuter-contributions-limits/